Introduction

- The above-named Article describes “an overview” of the purpose to which the “substantive contents” will be continually “populated” and “grown”, on a regular basis making its functionality extremely powerful.

- The “substantive contents” will be continually “populated” and “grown”, on a regular basis as events transpire.”

- By its nature it is “dynamic”, and it is recommended that a request be made for its update, where the last dated updated is greater than the last thirty working days.

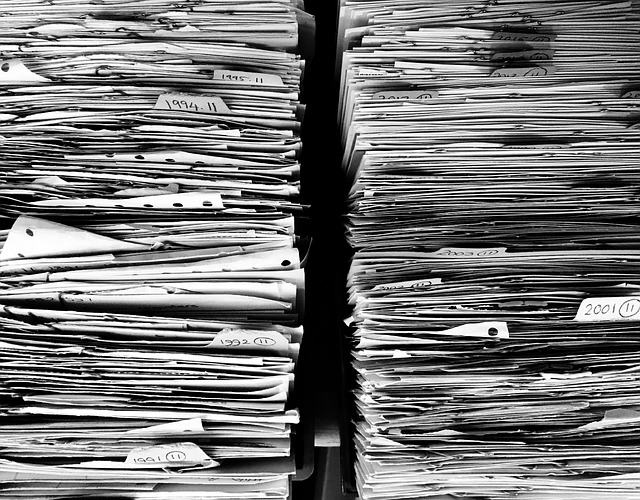

Digital Record Keeping for VAT

- All VAT registered businesses must keep and preserve certain records and accounts.

- Under Making Tax Digital (MTD), some of these records must be kept digitally within authorised functional compatible software (refer to paragraph 4.2 and 4.3 in the link below).

- Records that are not specified in this notice, or that are not required to complete the VAT Return, do not need to be kept in authorised functional compatible software.

- Some software will record all your VAT records and accounts information. However, there are some records that by law must be kept and preserved in their original form either for VAT purposes or other tax purposes.

- For example, a business must keep a C79 (import VAT certificate) in its original form.

- Example 1

- A business receives an invoice and enters the required data contained on the invoice into functional compatible software.

- They must keep the invoice in its original form as the data in the functional compatible software is not a copy of the invoice.

- Example 2

- A business has functional compatible software that scans the invoices received and puts the information in its ledger.

- If the image is retained and contains all the details required for VAT purposes, then the business does not need to keep the original invoice, unless it is required for another purpose.

- If a business deregisters for VAT, then it no longer is required to keep digital records for VAT purposes only, in functional compatible software, but must retain VAT records for the required legal period.

- VAT notice 700/21 gives more information on keeping VAT records.

Useful Links

Digital Record Keeping Publication